Furthermore, demonstrating compliance with past grants can enhance an organization’s credibility and increase the likelihood of securing future funding. The primary difference between regular accounting and grant accounting lies in the high level of specificity and accountability required in the latter. Among their fiduciary duties, members of nonprofit boards are tasked with ensuring the financial health and setting the strategic direction of the organizations they govern.

Tax Technology: To Build or To Buy?

However, with federal, state, and local support many have weathered the financial difficulties over the past 18 months as well as can be expected. As organizations move forward, they will have to account for how they survived, where the monetary support came from, and where the money went. The near future will require unprecedented diligence, flexibility, and perhaps most of all, patience. Instrumentl is the all-in-one grant management tool what is grant accounting for nonprofits and consultants who want to find and win more grants without the stress of juggling grant work through disparate tools and sticky notes. For instance, trend analysis can reveal patterns in expenditure, thereby aiding in more accurate budget forecasting. Additionally, data analytics can provide insights into the effectiveness of grant-funded projects, helping organizations maximize the impact of their funded initiatives.

Related Services

Similarly, a course provider could enter into a contract to provide three lectures at various different times and a textbook either on day one of the course, or on receipt of payment/registration. Within both FRS 102 (September 2024), Section 23 Revenue from Contracts with Customers and FRS 105 (September 2024), Section 18 Revenue from Contracts with Customers, is a five-step comprehensive model for recognising revenue. Innovate UK is another government grant scheme, but this focuses on innovative enterprise ideas. They provide a huge variety of funding opportunities throughout the year, which usually centre around a particular industry or type of product. Most grants are for a specific purpose — you might receive a grant to buy equipment or improve your marketing.

502 Open Grants Waiting For You

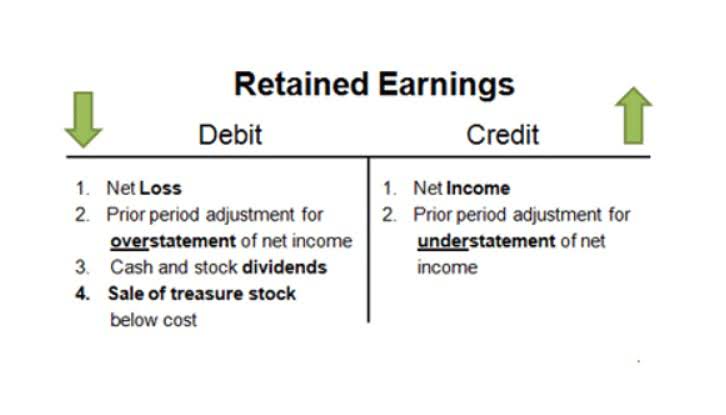

- Not-for-profits recognize contributions upon receipt, and exchange transactions either at a point in time or over time based on facts and circumstances.

- Grant accounting assures funders that their resources are utilized as intended and deliver the promised impact.

- Grants are the lifeblood of nonprofits, giving them the much-needed cash injection to market the organization, fund a project, or get an initiative off the ground.

- At first glance, accounting for government grants may appear to be relatively straightforward.

- For example, the terminology of “exchange transaction” will be superseded by “contract with a customer,” but the concept will remain the same.

While some founders might handle basic accounting tasks at first, professional accountants bring a high level of expertise and efficiency, especially as the business grows. Earlier this month, the state announced it will be giving out $2.6 million in grants to impacted small businesses. So far, the Rhode Island Commerce said it has received 130 applications from businesses in East Providence, 425 applications from Providence and 160 applications from those outside of the two communities. Hence, in the year to 30 June 2024, the entity would recognise £8,000 (£16,000 x 6/12).

This enables prompt identification and correction of any overspending, thus ensuring proper use of funds. A dedicated tracking system is essential for managing grant funds efficiently. However, with a clear understanding and effective tools, you’ll find it simple in no time. CFOs in the nonprofit sector are no longer solely focused on the finance and accounting function but have taken on a range of responsibilities that extend beyond traditional financial duties. If the contribution is considered unconditional, the final step is to determine if any restrictions exist and to recognize the revenue in the appropriate net asset class.

The most notable update is the extension of the single audit submission due date. However, the documentation showing the reason for the delay in filing must be retained. Additionally, regular monitoring and reviewing of financial activities can identify irregularities or discrepancies early, allowing for corrective action to be taken promptly. This not only safeguards the organization’s resources but also protects its integrity and reputation. This transparency can also build trust with funders, beneficiaries, and the broader community, enhancing the organization’s reputation and support. BDO is the brand name for the BDO network and for each of the BDO Member Firms.

Allocate Overhead and Indirect Costs

On 3 January 2026, Warrington Ltd enters into a contract with Wolves Ltd to provide monthly payroll services at a contracted price of £16,000 per annum. Lenny Industries Ltd enters into 30 contracts with its customers to supply various chemicals. Each contract includes the sale of one type of chemical with a sales price of £1,200. Customers can return the products within 30 days for a full credit and any returned goods can be used in other chemical mixes or sold again at a profit. The IT services provider and its customer have entered into an oral contract. The customer has provided payment details and consideration for the services to be provided, and the IT services provider is committed to performing the work on the customer’s server.